by Berend Booms, Associate Editor, Future of Assets

If there is one concept that is both universally accepted and endlessly contested in asset management, it’s business value. Everyone agrees it matters; few agree on what it actually means, and even fewer agree on how to measure it convincingly.

Underlying this friction is maintenance’s decade-long struggle with perception. All too often, asset management and maintenance management are framed as a cost center: a necessary expense, something to be minimized, controlled, or cut when budgets tighten. This skewed perception is also rooted in capricious visibility: when asset performance is stable, maintenance is invisible; but when something breaks down or an issue occurs, it suddenly becomes very visible. Because of this asymmetry, articulating business value is not an easy thing to do.

Most often, the benefits of good maintenance are presented as being preventive, offering cumulative value over the long term. I think this framing is misleading and due for a paradigm shift: maintenance does not merely protect value; it actively helps create it. If we assume that maintenance has the potential to actively contribute to business outcomes, the challenge becomes framing how that contribution is understood and aligned with broader organizational goals.

Business value in asset management does not show up in a single KPI. Instead, it emerges across several dimensions at once: controlling costs without impacting reliability, improving asset utilization without increasing risk, ensuring safety and compliance while keeping operations running, and making confident data-driven decisions about where and when to invest. In my experience, these dimensions are strongly connected, and treating any one of them in isolation tends to undermine the others.

The 4 Pillars of Asset Management Business Value

Cost is usually the obvious place to discuss business value. Maintenance budgets are tangible; they are visible to those in charge and as such easy to scrutinize. When organizations are looking to reduce costs, cutting the maintenance budget often proves counterproductive. Deferred or skipped maintenance has a habit of resurfacing later, and when it does, it is amplified by downtime, emergency repairs, and shortened asset lifecycles.

This is where mature asset management can make a real difference. Rather than aiming to spend less, we should aim to spend better. Structured maintenance strategies that are supported by reliable data allow organizations to break out of a reactive type of firefighting and instead work towards being in control of planned moments of maintenance. This drives value on multiple levels: not only are you reducing costs, but you are also realizing greater predictability and reliability within your operation.

Once organizations move toward more proactive modes of maintenance and establish a degree of control, asset management helps drive value by improving overall asset utilization. Well-maintained and reliable assets perform closer to their intended capacity for longer stretches of their lifecycle, with fewer disruptions and less variability. This reliability has a beneficial impact on production planning, throughput, and service delivery. The value that asset management creates is not at all exclusive to the maintenance function; it ripples outward into operations, logistics, and at the end of the line, customer experience.

"The value that asset management creates is not at all exclusive to the maintenance function; it ripples outward into operations, logistics, and at the end of the line, customer experience."

Less flashy perhaps but certainly not less important is the value potential in safety, health, environment and quality (SHEQ). Compliance is often regarded as a burden, precisely because its success is measured in things that did not happen: accidents that were prevented, fines that were avoided, incidents that never escalated, and people that were not injured. These benefits are more difficult to quantify in simple financial terms, but their impact on organizational resilience and reputation is not to be underestimated.

Finally, business value becomes especially visible in how organizations make investment decisions. Repair-or-replace discussions are some of the most consequential challenges asset-intensive organizations face. When those discussions are guided by maintenance data rather than gut feeling, asset management provides the opportunity to extend asset lifecycles, defer unnecessary investment, and deploy capital in such a way that it has the greatest long-term impact.

What ties these four pillars together is a simple but sometimes uncomfortable truth: creating value in asset management often requires spending money. This can feel counterintuitive in organizations where maintenance is still viewed primarily through the lens of cost control. Yet the most effective asset management strategies I have seen recognize that value is not generated by minimizing spend across the board, but by directing investment to where it has the greatest systemic impact. Investing in the right maintenance at the right time reduces downstream costs, stabilizes operations, lowers risk, and enables confident decision-making around capital allocation. As articulated by Mainnovation, maintenance creates value not by being cheap, but by being deliberate. When organizations shift their focus from “how do we spend less?” to “where does spending create the most value?”, maintenance moves out of the cost-center narrative and becomes a strategic driver of long-term business performance.

B is for Books: A Different Kind of Investment

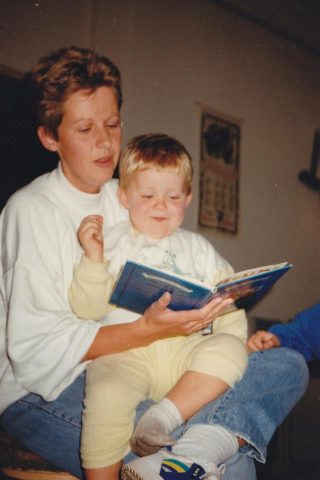

When I was younger, reading was one of those activities that absorbed me completely. I enjoyed reading so much that I would often do so well past the moment I was supposed to be asleep. More than once, one of my parents would come into my room at night to find me reading under my blankets with a flashlight. For me, books were a sort of escape from reality, but also a worthwhile investment of my time. They helped me discover the world, exposed me to ideas far beyond my immediate environment, and gave me a new outlook on life. The value of this “investment” was never really measurable or demonstrable. It compounded slowly over time, in ways that I am just now beginning to realize.

I completed a minor in literature at university, and over my 37 years on this planet I have read a fair number of great books. Like most people, I have favorites: Albert Camus, Aldous Huxley, Walter Moers, Jack Kerouac, and Hunter S. Thompson to name a few. What I appreciate most are not the individual stories or characters, but the way some of these books have shaped how I look at the world. They taught me to sit with ambiguity rather than rush to resolution, to pay attention to the invisible systems and incentives that shape behavior, and to appreciate that meaning is often found not in certainty, but in continued engagement. They showed me that perspective and voice matter, that stepping outside the mainstream can be both unsettling and deeply clarifying, and that imagination does not dilute rigor, but sharpens it.

My love for reading has never felt like “value creation” in the traditional sense. Most often, it is simply something that I enjoy doing to pass the time. But over the years, most of the books I’ve read have contributed to my ability to synthesize ideas, question assumptions, and connect dots across disciplines. They have shaped how I approach both life and work, with their lessons blending into a way of thinking that I have come to hugely appreciate: curious, critical, and comfortable with complexity.

Taking a Leaf Out of the Maintenance Book

There are definitely some similarities between asset management and reading. The benefits of both accumulate gradually rather than dramatically. And if your definition of value is limited to immediate output, you might not appreciate what “good” maintenance or a “good” book have to offer.

Whether in asset management or in enjoying a good book, value is not created through shortcuts. It emerges through consistency, patience, and an appreciation for long-term outcomes over short-term optics. This is ultimately what I consider to be the shift embedded in “business value” as it is so often discussed in our industry. It’s about moving beyond constraining definitions of efficiency and embracing a broader understanding of contribution. Maintenance teams have been creating value for decades; it is time we articulate that value in a way that resonates with how organizations actually make decisions.

"Whether in asset management or in enjoying a good book, value is not created through shortcuts. It emerges through consistency, patience, and an appreciation for long-term outcomes over short-term optics."

My love for reading taught me early that not everything worth doing delivers immediate or easily measurable returns. Asset management has only strengthened that belief. In both cases, value is created long before it can be proven, and often long before it is acknowledged. The return on investment may be difficult to express in a single number or KPI, but it shows up in better decisions, stronger systems, and more resilient organizations. The real challenge is not proving that business value in asset management exists, but learning to recognize it before its absence makes that value obvious.